No one who feels like they can’t purchase a house is gonna say the economy is good. Very simple concept.

Also, this…

Economic signs are improving, but many Americans don’t feel the relief. Inflation showed signs of cooling and both stock indexes and corporate profits are up. But many Americans aren’t feeling any economic relief.

https://www.cbsnews.com/video/economic-signs-are-improving-but-many-americans-dont-feel-the-relief/

Simple and wrong-headed concept.

The US economy and one’s personal financial situation are separate situations.

The economy is doing great, high dollar value, low unemployment, new job creation, small business subsidies, government investment, it’s all greatly strengthening the dollar.

That’s the strong economy.

Regulatory economic practices and corporate lobbying against fair pay and price limits on housing and living essentials has been increasing for the majority of Americans for decades.

No unions, no labor rights. No regulatory oversight, no mortgage caps.

The economy is doing great and it has nothing to do with grocery prices or something like gasoline which is largely imported and based on the whims of a single family thousands of miles away that wakes up and decides what the price will be.

The US economy and one’s personal financial situation are separate situations.

I think the point no one is outright saying is that yes, you’re correct. However, that shouldn’t be the case.

Many Americans find it appalling that we measure the economy by stock prices which don’t reflect the economic situation that is experienced by the vast majority of Americans. They believe that we should measure the economy based on things like housing and food affordability, with less emphasis on the economic situation of the wealthy few who don’t need to worry about those day to day concerns.

I wouldn’t change the definition of economy simply because the term is misunderstood or pigeonholed.

With “the economy” being an accurate term for a complete financial system, we should use accurate terms like affordability or livability to describe livability and affordability problems rather than a vague, tangential unrelated term.

The economy is very strong, affordability is at a low.

National forests are very healthy, my house has termites.

The abstract number of trees is irrelevant to the termites in a house.

It is nice that the US economy is strong, it is not nice that US affordability is so weak.

It is nice that this restaurant has so many windows, it is not nice that my chicken was overcooked.

When people rate the economy they are looking at their personal situation. The article is complaining that people aren’t looking at all these economic indicators, but it’s not clear why they would care about them if they personally are facing hardship.

They shouldn’t care about the economic indicators but they should care about their own interests.

Conflating the economy with your personal finances is like conflating the number of trees in your country with the state of repair of your house.

The government could invest in planting new trees and agricultural maintenance, but that has nothing to do with how your wooden house was built.

Similarly, the economy, the ecosystem of finance, can be very strong without affecting your personal financial situation, since the two are unrelated.

How many trees are planted and how healthy the trees are doesn’t have much to do with the carpenter who used cheap wood or poor insulation when building your house.

This misunderstanding is an example of false equivalence: The economy means money, My finances means money, so the economy means my finances.

Since the US economy is completely separate from control over your personal finances (except for the stimulus checks), the health of the economy has nothing to do with how much your bosses choose to pay you or the benefits you are given.

That’s determined by the corporation employing you and the regulations they follow.

Those circumstances can be changed by laborers joining a union, the national labor relations board, the ACLU, grocery regulations, by good in responsible social decisions in general.

low unemployment

Unemployment is a flawed 6-month rolling window metric that is ostensibly meaningless.

It’s also bullshit that it doesn’t include people who want employment but have given up due to being unable to find adequate employment.

It is pretty significant in terms of how many jobs are filled within a totally economy, spending trends, which affects how strong the dollar is.

It’s an important metric, important as any other anyway.

When people write about “the economy”, including the person who wrote this article, they generally focus on just two things:

- Inflation

- Unemployment.

Those are the two things mentioned in the subtitle of the article. It’s no coincidence that those are also the two priorities of the Fed. And those are also the two macroeconomic indicators that are most likely to affect American personal finances. The first one relates directly to gas and grocery prices, BTW.

So there is good reason to be glad when the economy is doing great.

Inflation indirectly relates to gas and grocery prices.

More directly important to those prices is the arbitrary pricing system in place that allows corporations to make up and change prices at their whim.

Inflation is a direct measure of prices.

I just want stable prices, which means I just want low inflation. How that is achieved doesn’t matter so much.

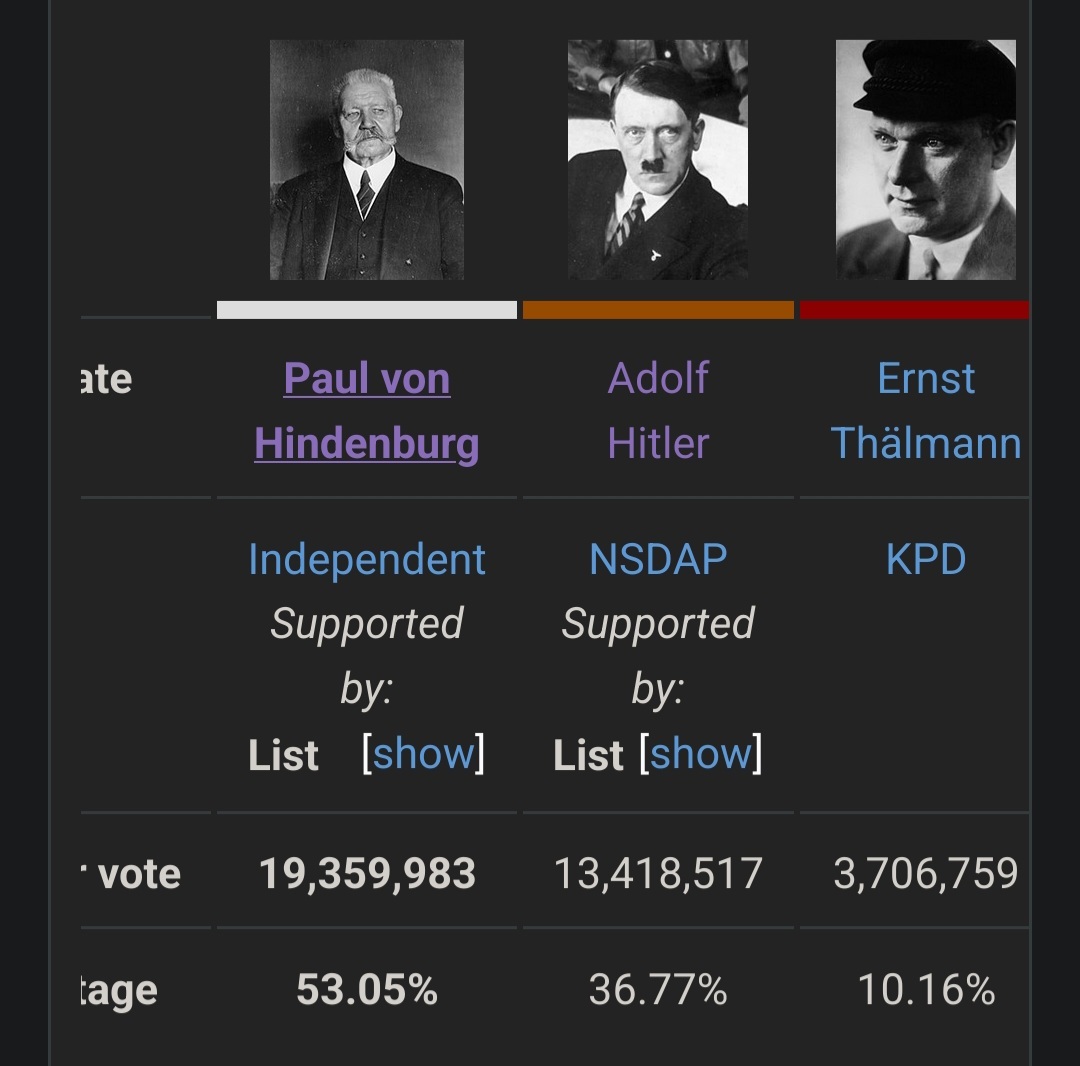

Yep. Just like it was in Germany in 1933. Think about what happened back then…

It was 1 year earlier; 1932

An 84-year-old incumbent party-line centrist was running against Hitler, and the left party at the time spent all its time attacking the centrists (they called the establishment left party “the main enemy”), and ran their own third-party candidate in the election, siphoning votes away from the center.

A few years later, Hitler had managed to seize power and most of the leftists were in the camps or dead. They were the first of his targets, even before he started working for real against the Jews.

I’m being a little bit selective about it to emphasize the similarity with today, and glossing over some important differences in the situations. But also, the situations are eerily similar, at the core.

It was 1 year earlier; 1932

Well, the ramp up to the “Machtergreifung” was, but the actual ascend to power was 1933. Again, just like in the US: Vote in November 2024, inauguration Januar 2025.

But also, the situations are eerily similar, at the core.

Which makes me shiver. I know that most Americans learn only a very limited subset of history in school, and they get even that wrong (How many people in the US still call the civil war the “War of Northern Aggression”?). If I were a history teacher in the US, I would see to add a thorough lecture about first half of 20th century Germany at the next avalable chance. And tell them why American soldiers gave their lives to fight it.

And maybe they should add “The Wave” by Morton Rhue to the literature curriculum, if they have not done that already.

They voted a genocidalist who also happened to have some big industry projects that revived the economy.

Not really a great comparison considering both POTUS options are genocidalists with pork barrel projects that won’t actually revitalize the economy.

But only one has an openly fashist agenda. And it pains me to see that Americans know so little about world history that they don’t recognize this.

It’s earily identical to the 1932 election candidates.

Hindenburg was the centrist incumbent, he didn’t go around publicly calling for genocide like Hitler did, but then he placed Hitler and some other Nazis in key leadership positions because he wanted to ally with his party, and two years later Hitler seized power after his death.

Biden has never called for a genocide, yet he has been actively funding one for 8 months while all the progressives in his cabinet are quitting. He seems unbothered by an election loss to Trump so long as the Pentagon’s foreign policy succeeds. I wouldn’t even be surprised if he dies in the next 2 years considering his health and stress of being president.

People don’t understand that Trump is a symptom and not a cause of the system. Even if he loses this election or dies or is disqualified, another equally or even more insane Republican will take his place. Meanwhile Democrats have refused to actually pass sizable progressive policies for 30-40 years. Biden only got to make his $15 minimum wage promise for only federal employees via an executive order because the party fell apart in congress with an actual bill. This will only lead to more republican voters.

Part of the issue is two party politics, but another part is the DNC refusing to combat fascism because surpsise surpise their candidates are funded by huge megacorp lobbyists who want to protect their corporate interests. Biden winning will not fix the problem, and 4 years down the line we will be faced with the exact same scenario.

Part of the issue is two party politics

Which is also just a symptom of a FPTP election system. To get anywhere, this has to go first.

Ask any historian what are the lessons of the 1932 German elections, and they’ll tell you: If you’re upset about the establishment incumbent, and specifically the state of the economy, it’s okay to overlook serious warnings about the other guy

Despite a low unemployment rate and slowing inflation, many Americans believe the economy isn’t doing well because food and gas prices are still high.

Well, the government isn’t gonna induce deflation. Wages may rise, and a low unemployment rate contributes to that, so the price may fall relative to your purchasing power, but in absolute terms, the prices are where they are.

“The real wages are increasing much faster than the inflation rate, which is very steady,” said Kishore Kulkarni, an economist with Metropolitan State University in Denver. “And therefore, the real wages are in fact increasing, but people are not feeling it because there is so much negativism outside.”

And there you are.

Are they really telling struggling Americans they’re just being “negative” and everything is fine?

As I quoted in my comment, wages are rising faster than inflation, which means that purchasing power is increasing.

If what someone wants is for deflation to be induced and prices to drop in absolute terms, that’s not going to happen; creates a mess of problems.

Which inflation rate are you quoting, the true rate including food and fuel or an abstraction that ignores those inelastic categories?

I don’t know what they’re using, but the CPI – what most people use when referring to “inflation” – incorporates food, and food inflation over the past year is lower than any other component. So they’re not gonna wind up with a lower rate of inflation by excluding food.

12 months is a poor timeframe to use for inflation when the most relevant data to consumers today is 2021-2022, and again fuel is required to function in the US which I don’t see in CPI making it a poor indicator for real finances. Really though my point is metrics can be manipulated to sound good or bad but ignoring consumer sentiment is foolish for a politician seeking to be elected by those consumers.

The most relevant data is the most recent data.

I don’t care about 2022 data, because I’m no longer paid in 2022 dollars or paying 2022 prices.

By that logic we should only read last months data and forget the rest of history, but in reality people have memories and incorporate previous experience in their sentiment.

The CPI, which is the inflation measure most commonly used, includes food and fuel.

Those two numbers you are asking about (“true rate” or the abstraction), for the recent past, pretty much work out to the same value.

The CPI excludes some volatile categories, but it’s not a trick, in this case.

The tactic of bringing up that the CPI excludes some categories, and implying that if it did include them, it would show more inflation than what it does (including the pretty significant spike in 2022)… that actually is a trick, actually a pretty subtle and clever one. To make people think the economy is getting worse, when it’s getting better.

Edit: I made a top level comment with the guidebook to some of the other tricks

Anyway, CPI includes both food and fuel.

I didn’t actually know that, thank you. Yeah, I know there is some commonly cited “inflation” number that excludes some volatile categories but over the last couple years that actually doesn’t change the bottom line - but yeah, it makes sense that CPI would include all the common consumer goods regardless of volatility.

“Core inflation”, as the name suggests, excludes some things that are encompassed by CPI. But I think it’s cited much less often than CPI.

So I spent some time looking into this wage increase stuff and I did find this fun chart with inflation adjusted wages growing 2% in the last 5 years, that’s pretty paltry compared to the corporate profit increases. I’d bet that power imbalance is a large factor in consumer sentiment falling against otherwise good looking economic data.

We’re in a weird economic time right now where the median is actually misleading.

Wages at the bottom are going up hugely (beating inflation by 12 percentage points). Wages at the middle (median) are pretty much unchanged as you noted. Wages at the top are falling behind inflation. I.e. inequality is going down for the first time in God knows how long.

I talk about it elsewhere in the thread and link to a couple articles, but the short answer is that you’re not wrong but median real wages aren’t the whole picture right now.

And yes corporate profits are a huge problem. There was a huge corporate tax increase in 2023 that funded some of the stuff the led to the 12% wage increase at the bottom end, but it’s nowhere near enough.

“the economy is great blah blah blah.” Fuck you, make food and rent cheaper, then I’ll believe that the economy is doing well.

Make everything cheaper! We are being price gouged left and duxkibg right

What the media and people with money call the economy is a different thing to what everyone else calls the economy.

But it’s really useful for them to pretend it’s the same thing.

They think of it as “our wealth” and we think of it as “everyone’s wealth”.

According to people who answer polls

The problem with inflation is that the cat can never go back in the bag. Sure, the Fed says they have inflation “under control” at the moment, but it’s still way higher than where pre-covid projections predicted it would be at this time, and real wages have not nearly caught up to the increased prices that literally everyone who earns a paycheck for a living is feeling right now. High cost of groceries and gas will never go back to the way they were, and no matter who ends up sitting in the Oval Office next January, they won’t be able to change that fact.

Workers across the country need to wake up and realize that they outnumber the owner class 10,000 to 1. A general strike could grind the entire nation to a halt and then they’ll start listening to what we have to say. The politicians in Washington have already signaled that they don’t care if average people can’t make ends meet and nobody is coming to save us, so we have to take matters into our own hands using the tools proven to work time and time again - worker organization.

So there’s a pretty concerted effort to make “the economy is actually getting better” stories sound untrue with some particular talking points - it’s actually really effective. Here are some of the big ones. You can see why they work.

- Replying to “the economy is getting better” with “how DARE you say the economy is good and all the problems are fixed, clearly that’s not the case” as a way of reframing away from the conversation of whether things are getting better, or worse, and why that is. Basically interfering with the effort to understand the policies that help or hurt by simply asserting that everything’s bad, so nothing being talked about can possibly be a good thing.

- Saying “well I’m not doing okay, how dare you say I’m not struggling” and getting all fucked up and angry about it, so that anyone that tells you that millions of low-income workers are making more now than they were a few years ago, like way more, and that’s a good thing, looks like an asshole

- Bringing up that the CPI excludes some categories, and implying that if it did include them, it would show more inflation than what it does (including the pretty significant spike in 2022). This one is actually a really clever subterfuge, because of how complicated it gets to explain why it is wrong (whereas if you just say “CPI doesn’t include housing costs” or whatever, people can grasp that instantly and make the connection and assume that housing costs would change the value if they were included).

- Saying “well who cares about the stock market, I just know I’m struggling” when no one said anything about the stock market or the rich-person economy metrics, and everyone’s talking about inflation-adjusted wages and nothing about the stock market

They’re all tricks. There are more but those are some of the main ones

And you see the same 4 or 5 of them, over and over again, if you start looking

You’ll see some of them in comments nearby to this one, I guarantee it

Edit: More

- Insisting that when cumulative inflation is 20%, and 10th percentile wages have gone up 32%, wages aren’t keeping up with inflation, simply because you insist that they aren’t. If anyone tries to say numbers, just say they don’t count.

- Focus on the 20% inflation, because it feels real. People can see it in grocery prices, it’s tangible. It rings true. The wage growth is mostly at the low end (truck drivers, housekeepers, manufacturing) where most Lemmy users can’t see it, and even when someone’s wage has gone up, it’s easy to decide it happened because of some other factor, whereas $7 for a carton of eggs is right there in your face and memorable. And universal.

What are these “tricks” for? Millions of us out here are struggling. “But you’re earning more money!”… Ok, a dollar more? While everything else has gone up including rent with a near 40% increase in the last few years in some places.

To just be so dismissive of those barely surviving sounds like you’re coming from a place of privilege.

You’re right, I missed a couple

- Insisting that when cumulative inflation is 20%, and 10th percentile wages have gone up 32%, wages aren’t keeping up with inflation, simply because you insist that they aren’t. If anyone tries to say numbers, just say they don’t count.

- Focus on the 20% inflation, because it feels real. People can see it in grocery prices, it’s tangible. It rings true. The wage growth is mostly at the low end (truck drivers, housekeepers, manufacturing) where most Lemmy users can’t see it, and even when someone’s wage has gone up, it’s easy to decide it happened because of some other factor, whereas $7 for a carton of eggs is right there in your face and memorable. And universal.

This is also a little bit of the getting angry or fucked up tactic, too. See? I look like an asshole now, with all my numbers.

Just making up a number of 40% inflation I haven’t seen before. I don’t think that’s common enough to warrant an entry of its own. Want to show me where you got 40% from?

When your rent goes up 40%. As pandemic fades, many tenants see big hikes

Got it. So, back in November of 2021, someone wrote a story with a clickbaity headline about 40% rent increase in the future from back then, and now to you that’s reality you are citing to me. Great stuff.

Anyway, here’s the actual numbers. The median rent went from $1,102 to $1,340 in those 3 years - 21.5% cumulatively. That’s what happened. So someone who’s low income who’s making 32% more comes out ahead. Does that mean that can afford their rent, when it’s $1,700 because they’re in a metro area and they make $16/hr? Fuckin A, man, maybe not. I’m being an asshole to you in this conversation a little bit, just because I know that you’re deliberately twisting things to make Biden look as bad as possible (as confirmed by you which was what got you temp banned already). But I’m not trying to be unsympathetic to someone who’s actually struggling and being honest about how they’re struggling.

But maybe we should keep doing more of the stuff that gave them the 32% increase, and in a few years they’ll be able to afford the $1,700 or whatever it is by then. Right? Or not? What would your solution be, instead, if not that?

I think you’re out of touch on the dire situation Mozz. You can throw statistics and numbers around but for millions of the working class, they’ve never struggled as much as they are currently.

Eight of the top 10 metro areas are in the Sun Belt region. Rents in each of these metros have increased over 37% since 2019.

I don’t want to play the debunking game all night. I read your link, and here’s their rent increases:

Rent in the area went from $582 to $907, or a 55.8% increase.

Rent for 1-bedroom apartments increased 49.5% from $646 to $966 from 2019 to 2024.

And so on. It looks like they sorted every metro area in the US by percentage increase, which yields a whole bunch of individual metro areas with oddball markets where some super-cheap pandemic pricing ended and so the percent increase in places where it had been $582 for a 1 bedroom apartment during the pandemic, was pretty high. That doesn’t mean the price of housing in general went up by that same high percent.

Like I say, someone who’s actually struggling, I have sympathy for. You, I don’t, because you’re just out here lying with statistics to try to hurt the people you are claiming to have all this sympathy with.

It looks like they sorted every metro area in the US by percentage increase, which yields a whole bunch of individual metro areas with oddball markets

This is the entire reason why people critique nationalized metrics on economic trends: they intentionally disregard figures that fall outside the norm so that they can apply a fed policy for the entire country, favoring the overall economic performance instead of addressing the localized economic shortfalls. It’s like a doctor trying to diagnose constipation by reading someone’s vitals; none of the experience of the patient can be seen on the metrics they’re using until it’s literally killing them. “You say you haven’t shit for 8 days but your BP is 120/80 so you must be fine”.

Like, sometimes those metrics overlook really important possibilities, like unemployment not accounting for people who need multiple jobs, or total job market numbers not accounting for ghost positions and high turnover. CPI is used for setting fed interest rates, and it tosses out specific categories because the prices move too fast to gauge the effect of interest rates on those prices. They’re not trying to measure how well people are surviving, they’re measuring how economic output is adjusting to the supply of cash. That’s why they have CPI-U, it adds those categories back in so that they get a better picture of how people are experiencing the market. Notice, though, that even real wages doesn’t have any way of reflecting anything about where those wages come from; whether people are taking on extra jobs or if their work hours are increasing without extra pay, or if a transient spike in COL depleted your savings and you’re right on the edge of instability. Those numbers tell an extremely narrow story about the state of the economy, and if there are a bunch of people who are telling you ‘this number isn’t reflective of my experience’ then maybe you need to take a more granular approach to the data.

It’s exhausting watching this from the left, because depending on who is in office the chosen metrics for assessing the economy change. For 2016-2020 the metric was stock indexes and GDP, for 2020-present it seems to be CPI and unemployment. Neither party likes talking about high-interest credit, or job security, or retirement savings, or healthcare costs or realestate affordability, and that’s infuriating. There are a growing number of ways people fall through the cracks of economic instability and the averages are designed to throw those out as exceptions. You lose your job and fall into drug addiction? Sorry, that’s not the ‘average’ American. You get into a car accident and can’t pay your medical bills? Sorry about that but that’s not relevant to the bigger picture. All we can see is ‘you should feel good/bad about the economy for these abstracted reasons’, and then you get partisan fanboys yelling at you that you’re wrong if your experience doesn’t align with that national picture. It’s even more frustrating when the same people are are telling you things are great are simultaneously acknowledging that things should be a lot better.

‘You’re just trying to make people feel bad about the state of things’ - jesus can you just fuck off with that constant condescension? People feel shit about the economy because things are shit for a lot of people. More than a quarter of the country has less than $1000 in savings, maybe people are scared they’re a single accident away from homelessness and your national metrics simply don’t show that. My parents are talking about EOL plans and I’m realizing I don’t make enough to support them. How does CPI account for that? It fucking doesn’t.

“Things are relatively better through this narrow view of the world” - well why the fuck should I care if i’m not in that picture?

Bruh. Everybody is struggling, wake up…

People are struggling with the cost of living. TikTok rants on inflation and high prices… https://youtu.be/V9SMRjulRTE

I don’t feel the economy is getting better but I blame inflation on trump not continuing obama slowly raising interest rates and so when covid hit we were already at zero. Covid actually saved trump from inflation on his watch as we reduce demand for about a year or so amount of resources which managed to shift it to just out of his term.

Let’s say the economy is doing better… It is still not better enough. People should be able to retire by 50.